4 Years After the Hack Incident, Euler Quickly Recovers Its “Trust High Ground” and Becomes One of the Core Drivers of the Resurgence in the DeFi Lending Sector

Recently, $EUL reached an all-time high, with prices briefly breaking the $15 mark, rising over 950% from its low at the end of 2023. Its market capitalization is approaching $300 million. Although there has been a slight pullback, the current price stabilizes in the range of $11.8–$13.

Factors driving the rise of Euler include:

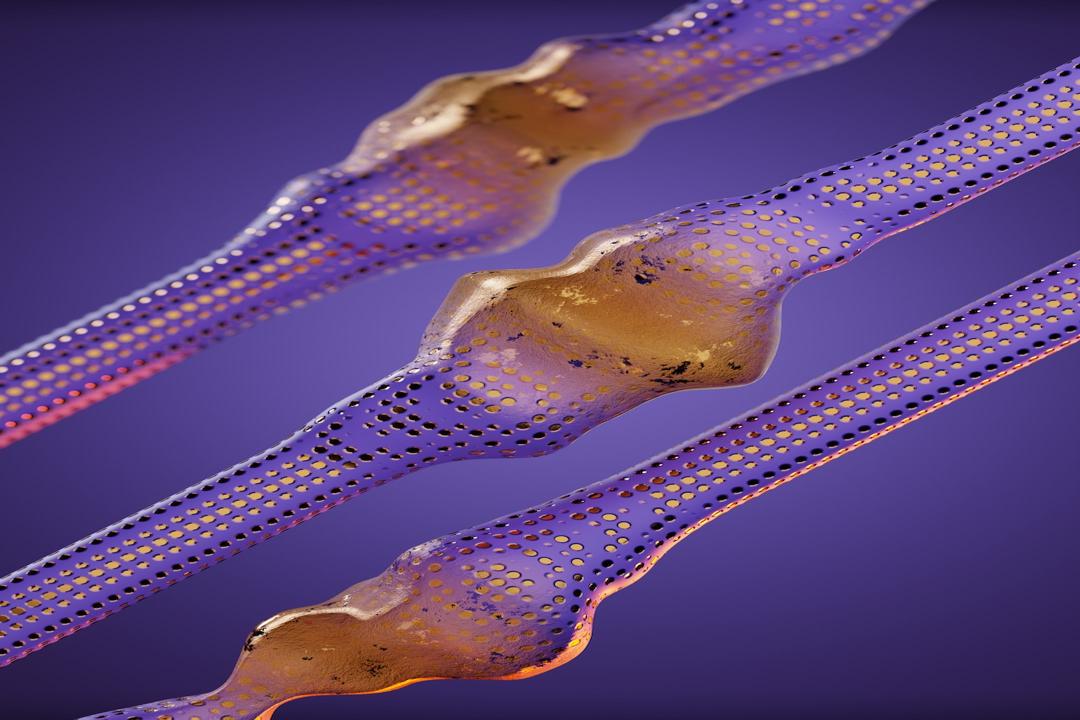

- Rebirth from the Ashes: Euler quickly restarted after the hack incident, winning back community trust and capital inflow, which is a crucial foundation for its significant rebound.

- TVL and Lending Depth on the Rise: The abnormal growth of TVL and the surge in active loans reflect strong user demand for borrowing and the revival of the protocol’s momentum.

- EulerSwap Complements the Ecosystem: After launching the native DEX, Euler established a self-circulating liquidity path, creating a closed-loop connection between staking, lending, and trading.

- Mainstream Platform Support Intensifies: Recent news indicates that Coinbase will support EUL, which prompted a roughly 5.7% price increase on the day of the announcement, reflecting an increase in capital market recognition.

Latest data shows that Euler’s TVL has reached $1.2 billion, effectively overcoming the impacts and challenges following the hacker incident. Euler launched its native DEX—EulerSwap, which has accumulated a trading volume exceeding $1 billion since its launch in May. Active loan volume recently surpassed $1 billion, a significant increase compared to about $240,000 at the end of 2024. Euler’s recovery is a classic “rebirth from the ashes” story: from the dilemma post-hack to rapid restart, explosive TVL growth, product innovation, and gradual recovery of market capitalization and attention, showcasing the resilience of veteran DeFi projects in terms of trust and governance.

However, it is worth noting: the pullback pressure following high prices; whether EulerSwap can maintain trading depth and whether the variety of lending products can expand will determine its continued growth; and whether more capital platforms will continue to support, such as deeper support from Coinbase and more CEX listings, will enhance liquidity and market capitalization foundation. If Euler can indeed sustain TVL growth, loan activity, and DEX construction momentum, it is expected to return to a higher valuation range, continuing to write the classic “old tree rejuvenating” chapter.

Pendle: Driven by Boros, TVL and Prices Soar

Pendle is a DeFi protocol that allows users to “trade future yields,” with a core mechanism of splitting any yield-generating asset into “Yield Certificates” and “Principal Certificates,” enabling users to freely trade future yields. Pendle V3 introduced the Boros platform, creating advanced yield trading tools and has become one of the core infrastructures for yield trading. Pendle has recently performed brilliantly: prices briefly approached $6, with a weekly increase of up to 46%, far exceeding the overall market trend.

Factors contributing to Pendle’s rise include:

- The Launch of the Yield Trading Platform Boros: After Boros was launched, BTC/ETH funding rates were converted into tradable assets (Yield Units), rapidly boosting user participation and capital inflow.

- Cross-Protocol Integration Mechanism Optimizes Capital Efficiency: Interactions with Ethena, Aave, and Boros make Pendle a hub for efficient yield strategies, leading to an increase in capital volume through its PT-USDe strategy.

- TVL and Yield Growth Boost Confidence: The record-high TVL and surging income provide strong support for the token and enhance market sentiment.

On core metrics, Pendle’s TVL reached a historic high of $8.8 billion, primarily driven by the capital explosion from the Boros platform. In the first two days post-launch, it attracted over $1.85 million in BTC and ETH deposits, with the number of active addresses on Arbitrum doubling, attracting on-chain and institutional attention. Meanwhile, protocol integration drives liquidity explosion. About 60% of the TVL comes from the USDe strategy (such as PT-USDe generating leverage and liquidity on Aave), creating a powerful “yield-loop” asset circulation mechanism.

Pendle is emerging as a new frontier in DeFi due to its unique yield trading mechanism and protocol integration strategy: the Boros platform injects strong momentum, leading to simultaneous explosions in TVL and prices. However, caution is warranted regarding short-term technical pullback risks and the concentration risk brought by USDe’s dominance. If Pendle can continue to expand Boros-supported assets (such as staking yields and government bond yields) and promote overall protocol governance and ecological integration, it has the potential to challenge the $7–$8 range, advancing toward a true “old project new chapter.”

Aave Crowned King of Lending Again, Gradually Institutionalizing

Aave is the top lending protocol in the DeFi world, known for its non-custodial, modular design, and cross-chain support. Its innovations, including the GHO stablecoin, Umbrella security mechanism, and Aave Arc/Horizon, further solidify its core position in the DeFi liquidity layer. Recently, AAVE performed impressively: in mid-July, the price surged to a high of $330, with a 24% increase over seven days, despite short-term pullback pressure at high price levels, the overall trend remains strong.

Factors driving Aave’s rise include:

- Capital Inflow and Leading TVL: Aave remains dominant in the lending market, with a continuous influx of new users and capital, providing a solid foundation for market confidence.

- Improved Performance of the GHO Stablecoin Enhances Value Recognition: GHO’s cross-chain expansion, sGHO, anti-GHO mechanisms provide multi-layer yield incentives for holders, enhancing ecosystem stickiness.

- Institutional Pathways Continually Materializing: Horizon, Arc, and KYC compliance mechanisms make Aave an important entry point for institutional-grade DeFi lending.

From other core metrics, Aave’s TVL currently stands at $38.04 billion, a 52% increase since the beginning of the year, accounting for nearly a quarter of the total DeFi TVL, dominating the lending market. Its native stablecoin GHO has a circulating supply of $312 million, with GHO’s cross-chain expansion on Arbitrum and Base promoting revenue growth, and AAVE’s recent rebalance cycle yielding a return rate of 22.97%.

On specific institutional collaborations, Aave has launched the Horizon project to promote RWA and institutional usage pathways; partnered with Plasma to launch a blockchain fund for institutions; and Aave DAO has approved a white-label solution for Kraken Ink chain. As a “veteran” in the DeFi lending sector, Aave still demonstrates “strength in age”: continuously refreshing records in TVL and deposit size, expanding the functionality of GHO, and steadily advancing institutional pathways, all injecting strong momentum into its revival. However, AAVE’s price at high levels faces pullback pressure, with technical indicators like RSI nearing overbought status, indicating potential short-term adjustments. Whether it can maintain its lead in the DeFi lending sector also depends on the progress of Aave V4’s launch, the effectiveness of RWA pathway implementation, and regulatory trends.

Spark: The Sword of MakerDAO

Spark Protocol (referred to as Spark) evolved from MakerDAO and is now part of the Sky ecosystem. It is a high-level on-chain capital allocator designed to efficiently deploy multi-million dollar stablecoin capital into DeFi, CeFi, and RWA (real-world assets). Its core products include SparkLend (lending), Spark Savings (yield generation), and Spark Liquidity Layer (cross-chain liquidity allocation). Since the official airdrop of the SPK token on June 17, 2025, its market performance has been remarkable: the original TGE issuance price was approximately $0.065, with SPK experiencing significant fluctuations—falling to less than half of the issuance price (around $0.03) before rebounding strongly, reaching the historical price range of $0.12–$0.13 on July 23, with a market capitalization nearing $190 million and a 24-hour trading volume climbing to nearly $450 million.

The main factors contributing to the rise of the SPK token include:

- TVL Explosion Boosts Market Sentiment: Since April, Spark’s TVL has skyrocketed by 250%, this influx of capital directly boosts market confidence, leading to a rapid recovery in SPK prices and setting an ATH.

- Airdrops and Listings Stimulate Trading: The launch of Spark was accompanied by a large-scale airdrop and listings on mainstream exchanges (such as Binance), establishing favorable mechanisms that heightened initial market attention and price volatility.

- Top-tier Capital and Technological Endorsement: Backed by the $6.5 billion stablecoin reserves of the Sky (formerly MakerDAO) platform and a transparent mechanism as the core of capital deployment, Spark is endowed with a strong steady-state foundation.

- Completeness of Product Structure: Spark encompasses a product matrix that covers yield generation, lending, and cross-chain liquidity, seamlessly connecting user needs through SparkLend, Savings, and SLL.

As of the time of writing, Spark’s total TVL has reached $7.4 billion. Previously, in July, the TVL reached a peak of $8.1 billion, making it the sixth-largest platform in DeFi, with SparkLend managing approximately $4.7 billion and SLL managing about $3.4 billion. Spark is rapidly reshaping the standards of stablecoins and capital efficiency in DeFi, with the resonance of TVL explosion, airdrop sentiment, and Sky endorsement enabling SPK to achieve a legendary comeback of “old project reborn” in a short time.

However, high volatility and initial profit-taking pressure remain, with prices currently having retraced by 30–40%, and short-term adjustments may be necessary. Whether it can continue to strengthen in the future will depend on Spark’s ability to continuously expand its ecosystem (such as CeFi pathways, RWA integration), governance activity, and SPK holder loyalty performance.

Risk Warning

Cryptocurrency investments carry a high level of risk, and their prices can be highly volatile; you may lose your entire principal. Please carefully assess the risks.