Manta Network ($MANTA) focuses on designing L2 blockchains with privacy protection technology. Recently, it participated in the 44th phase of Binance’s new coin mining, which further increased its already high attention due to the New Paradigm. This has raised the anticipation of participants in the cryptocurrency circle for its official trading on Binance at 18:00 on January 18th.

(Manta Network (MANTA) attracts 5.8 billion TWD through Binance Launchpool, becoming the 10th largest chain after Base.)

Table of Contents

Toggle

Accusations of market manipulation and money laundering against the Manta team

Manta Network: Innovator in privacy protection

Expanding in the Asian market: Manta Network’s strategic layout in South Korea and Hong Kong

Market performance of Manta Network

Accusations of market manipulation and money laundering against the Manta team

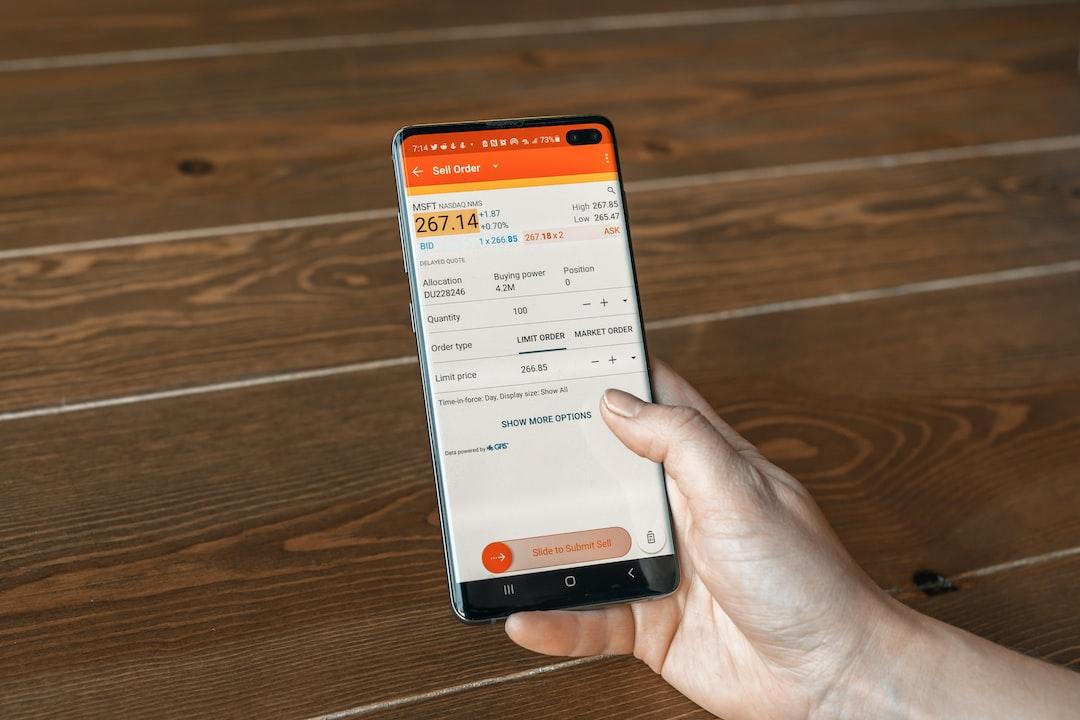

However, just one hour before the trading pair was opened, it was reported that Manta Network’s RPC endpoint crashed. Official personnel stated that they were under a DDoS attack. Users were unable to claim airdrops at that time, and there was a brief period where all trading prices were affected. However, users still could not claim airdrops or withdraw tokens to exchanges through on-chain transactions. This situation was sarcastically referred to by the community as “toilet data manipulation.”

The cloud of suspicion surrounding Manta Network-related transactions does not end here. According to Definalist, a South Korean crypto KOL, there was a large transaction involving Manta Network just before the token was listed, possibly involving dumping. According to on-chain data tracking, the wallet belonged to a Manta Network employee in South Korea. Through this transaction, the wallet received up to 2 million $MANTA tokens. In the situation where the supply was insufficient due to the front-end crash during the opening, they managed to complete the transaction and made a profit of $5.162 million, with an average trading price of $2.58, slightly higher than the current price by 20%.

In addition to the possibility of the team selling tokens during the network outage, the Korean community believes that these actions may involve money laundering. This is because the employee who sold the tokens had only been with Manta Network for five months and should not have had such a large share. However, the Manta team has denied the community’s accusations and stated that these funds were allocated to the Korean branch’s operational expenses from the Ecosystem/Community project in the token model.

In fact, the controversy surrounding the Manta Network token issuance does not end here. Manta Network was originally an ecological project on Polkadot and held a token public sale on the Tokensoft platform in 2021, raising $28.8 million. However, because the community believed that Manta Network did not actively provide Polkadot cross-chain support and faced RPC overload, many people were unable to obtain the tokens.

Manta Network is committed to developing and providing privacy protection technology for blockchain. It has built a modular Layer2 ecosystem specifically for zero-knowledge (ZK) DApps, offering low-cost and efficient user experiences.

The co-founders mostly come from Ivy League schools and have years of industry experience. Prior to its official launch, Manta Network received investments from top web3 VCs such as Binance Labs and Polychain Capital, with a valuation of $500 million, not far from the current market capitalization post-listing.

Currently, Manta Network is actively expanding its business in South Korea and Hong Kong. In addition to establishing local branches, it hopes to gain localized insights into the needs of the local population and integrate with different markets’ WEB3 ecosystems. The modular Layer2 ecosystem and zero-knowledge application development that Manta Network is committed to have great potential.

Looking at Manta Pacific’s roadmap, it will be the first to transition from Optimistic Rollup to Validium zkEVM L2. This transition will be implemented using the Polygon CDK and will significantly reduce gas fees through Celestia DA. It will also increase security through Ethereum consensus and encrypted proof of on-chain activities. Therefore, it can be said that it is a highly forward-looking L2.

According to official data from Manta Network, the Manta wallet has been installed over 200,000 times, and the comprehensive project ecosystem of Manta Network covers over 1.5 million users.

According to data from CoinGecko, nearly 80% of the current trading volume of $MANTA occurs on Binance Exchange, showing the influence of new coin mining. As of the time of writing, $MANTA is temporarily priced at $2.18, with a 16% decrease in the past 24 hours.

According to data from Defillama, Manta Network currently has a TVL of $410 million, growing 23 times in the past month, making it the tenth largest blockchain. LayerBank is the largest DApp on Manta Network, accounting for over 70% of the TVL.

According to data from token.unlocks, Manta Network has unlocked 250 million liquidity and will not be fully unlocked until 2030.

Manta

Manta Network

Related reading

Binance Launchpool – Manta Network (MANTA) attracts 5.8 billion TWD, becoming the 10th largest chain after Base

90% of people have peeked into someone else’s wallet address, blockchain privacy issues need improvement.