AI Concept, Never Lacking Market

As a narrative that spans the entire year, regardless of the fluctuations in the cryptocurrency market, AI projects always perform remarkably. In various inventory and outlook articles, you can almost consistently see optimism towards AI.

Advertisement – Scroll down for more content

However, AI is a very broad concept, so which specific sub-projects should one bet on?

A relatively safe choice is to use short-term hot events as catalysts and look for cryptocurrency projects directly related to the concept.

For example, AI agents.

On January 11th, ChatGPT officially launched its store function. Unlike traditional applications, the GPT store does not require users to have any programming experience. As long as users input their desired functions in simple natural language, the system will create a custom AI chatbot.

In simple terms, this is an AI agent store that contains a large number of robots capable of replacing you to perform certain fixed tasks according to certain logic. With the appeal of GPT, it is foreseeable that there will be an explosion of applications in the store, including possibly agents related to crypto.

Whether these robots are useful or not is one thing, but the popularity of the AI agent concept is another.

Almost at the same time, well-known cryptocurrency VC Pantera explicitly expressed interest in the combination of AI agents and Web3 in a recent lengthy article.

(Read more: Pantera 2024 Focus Areas: AI Trends Continue, Web3 Will Facilitate Development in Inference, Data Privacy, and Incentives)

If we consider the GPT store as a catalyst and the attention from top VCs as a gust of wind, will the narrative of AI agents be ignited this year?

We cannot predict the future, but we can be prepared.

So, what we should understand now is: what is the principle of AI agents and which cryptocurrency projects may directly benefit from it?

Table of Contents

Toggle

AI Agents, What is the Matter with the Cryptocurrency Industry?

Which Cryptocurrency Projects are Related to AI Agents?

Type 1: Cryptocurrency projects directly engaged in AI agent businesses

Autonolas ($OLAS): AI agents designed to optimize cryptocurrency projects’ efficiency

Fetch.ai($FET): An old project that serves as an AI agent for the entire industry

PAAL AI ($PAAL): Focused on building AI assistants for the cryptocurrency users

Type 2: Projects that enhance their existing businesses with AI agents

First, we need to understand how AI agents work, which will help us identify which cryptocurrency projects truly fall within the scope of AI agents and which ones are just riding the concept.

The robots in the GPT store give people a general understanding of AI agents. But in terms of principles, what kind of products can be considered AI agents?

In my opinion, judging whether a product is an AI agent can be simplified by focusing on the key question:

Using AI technology, can the program or device automatically execute tasks or assist users?

From simple chatbots to complex automated systems, they can all be considered AI agents. But these things should at least possess the following characteristics:

Automation: The ability to execute tasks with little or no human intervention.

Environment perception: The ability to perceive its operating environment through sensors or data input.

Decision-making: The ability to make decisions based on programming and received data.

Learning and adaptation: The ability to learn and improve performance based on new data and experiences.

Interactivity: The ability to interact with human users or other systems, respond to requests, or provide information.

However, if we abstract these features, we will find that AI agents are somewhat like smart contracts: given predefined conditions, they automatically execute results.

Therefore, to identify whether a project truly utilizes AI agents or just rides the AI concept with smart contracts, we can simply distinguish them based on the following dimension:

Is there initiative?

Smart contracts lack autonomy; they passively react based on pre-written rules (reactive) and do not have the ability to make autonomous decisions based on changes in the external environment. For example, you set a certain price and will buy a certain token when it reaches that price.

In contrast, AI agents are generally considered active, capable of collecting data, learning, making decisions, and initiating tasks without external commands. For example, monitoring market data and buying a certain token when AI itself believes the price is suitable.

Understanding this difference, let’s see how AI agents are related to the cryptocurrency industry.

The co-founder of the well-known cryptocurrency project Space and Time, @chiefbuidl, made a very classic and vivid analogy:

Cryptocurrencies are like cash, blockchains are like cash registers, Dapps are like POS machines, and AI agents are like cashiers.

Pondering this statement, when users transact with cryptocurrencies like cash, the underlying blockchains are actually responsible for recording and calculating. Dapps serve as transaction interfaces similar to POS machines, while AI agents become cashiers, directly saying to you:

Don’t worry about how to use the money or keep accounts; just tell me your intentions, and I will automatically spend the money for you and provide you with the services you want.

In this chain, cryptocurrencies, blockchains, and Dapps are actually complex and difficult to understand, while AI agents are the link that is most likely to interact with users, simplifying the process.

Therefore, AI agents can help make the user experience of cryptocurrency products better (including but not limited to the trading experience).

So, which projects are related to the concept of AI agents?

Perhaps we can categorize them into two types: projects that directly provide AI agent capabilities for others to use, and projects that enhance their existing products with AI agents.

Autonolas ($OLAS): AI agents designed to optimize cryptocurrency projects’ efficiency

Autonolas is a project directly related to AI agents. Its business is to design AI agents for the cryptocurrency industry to handle tasks in different scenarios.

Specifically, Autonolas’ tech stack includes:

Autonomous agent services

Composable autonomous applications

On-chain protocols for protecting agent services and incentivizing development

(Read more: In-depth Analysis of Autonolas: AI Agent-Driven Off-Chain Services, Product, and Economic Model)

The key here is autonomous agent services.

The AI agents that make up these services can extract data from any AI model in the world. It includes every GPT, LMM, or sub-network (which means it can even collaborate with $TAO). Through service coordination, models used to handle specific tasks are assigned to certain agents.

So, what can these agents specifically do?

Looking at the product collection presented on the Autonolas website, it involves businesses related to the cryptocurrency industry, including but not limited to using AI agents to predict the market and predict certain protocols.APY yields, acting as oracle to provide more accurate off-chain data, helping DAOs govern, automatically managing operational smart contracts, and automatically creating DeFi liquidity pools, and so on.

Overall, AI agents have a place in all process-oriented operations related to crypto projects.

Autonolas has two other businesses based on self-service. Through these basic self-service options, other developers can freely combine their functions to form their own applications. At the same time, Autonolas can also establish an application store, allowing developers to register and monetize their services.

From the data, the usage of AI agent services in this project is still increasing. As Autonolas theoretically can become a standard for all crypto projects, it can add a layer of AI agent capabilities to any part of its own project that requires automation.

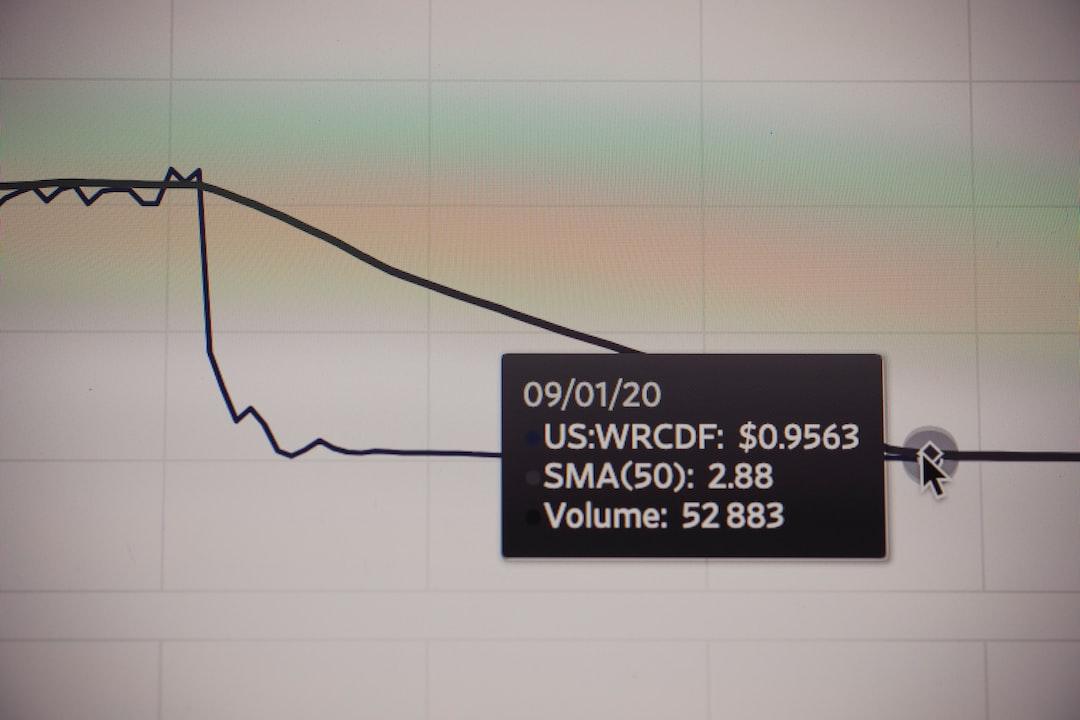

Its token OLAS was launched on the on-chain liquidity pool in July last year, with a price of around $0.1. The current price is around $4.6, and the market value has reached $200 million.

However, considering the narrative of AI and the role the project is expected to play in business, the current market value and price are not particularly overvalued. For comparison, $TAO, which also has an AI narrative but different business, has a market value of around $1.5 billion.

Fetch.AI (FET) also focuses on building and promoting AI agent services. These agents are designed as modular components that can execute specific tasks through programming. These agents can autonomously connect, search, and trade, creating dynamic markets and changing traditional economic activities.

Compared to OLAS, Fetch is a more established project. It was founded in 2017 and launched its mainnet in December 2019. It has already integrated with Cosmos’ IBC, making it an AI project in the Cosmos ecosystem.

However, Fetch is not only targeting crypto projects with AI agents but also extending its services to different industries. From the examples provided by the official website, its business can reach various services such as e-commerce, automotive, legal, IoT, and meteorology.

In addition, Fetch’s another feature is developer-friendly. Fetch has also launched Agentverse, a codeless management service that simplifies the deployment of AI agents. Just as traditional codeless platforms (Replit) and services like Github’s Copilot allow the public to write code, Fetch is striving to democratize Web3 development in its unique way.

Through Agentverse, users can easily launch their first agent, greatly reducing the threshold for using advanced AI technology.

However, as a relatively historical project, Fetch’s actual products are still in the wishlist stage and have not been fully open to the public. This also raises doubts about whether the project is really doing solid work.

In terms of tokens, FET serves as network gas fees and is also used for node staking to maintain network operation. Its market value has reached $500 million, and the author believes that its cost-effectiveness is weaker compared to OLAS, and the upside potential is relatively limited. However, it can still be seen as a relatively beta project and may experience certain price increases when there are catalysts in the AI agent narrative.

PAAL aims to create an AI-driven platform that is easy to access, user-friendly, and provides comprehensive knowledge, support, and tools in the ever-changing world of cryptocurrency and blockchain technology.

The project hopes to provide users with their own personal AI assistant, which they can rely on for accurate and reliable information, customization and scalability assistance, and a deeper understanding of the crypto ecosystem.

Specifically, PAAL can be understood as a crypto version of GPT and trading BOT.

PAAL’s main AI tools include:

– Mypaal: an AI robot with certain knowledge that answers various questions about crypto projects asked by users.

– Autopaal: acting as a crypto expert, providing research, insights, and analysis centered around cryptocurrencies, monitoring market trends, and notifying users of specific situations.

– Autopaal X (not yet launched): an advanced version of the above two tools, adding automatic trading functionality and sharing income with $PAAL stakers, providing additional incentives for staking.

If we look at it conceptually, PAAL can indeed be considered an AI agent, but its business focus is more on serving crypto users in trading and learning. If we don’t get caught up in specific differences, we can even directly understand it as an advanced trading BOT.

Currently, the total market value of the $PAAL token is around $100 million, lower than the previous two projects. However, considering its narrow business focus and its strong correlation with the crypto market, the overall imagination is believed to be not as high as OLAS.

The above projects are directly involved in AI agents, while some projects integrate this functionality into their existing businesses to enhance their performance.

Due to space limitations, we will not provide a detailed introduction to the principles of these projects. Here is a list of some of these projects:

– Root Network ($ROOT): Optimized L1 for metaverse, gaming, and Web3 user experiences, supported by Futureverse. It can already integrate AI agent capabilities into games supported by this network to enhance the gaming experience.

– Parallel ($PRIME): A sci-fi background card battle game invested by Paradigm. The game currently uses AI characters to create new in-game items, which can be stored in the AI characters’ own wallets, equivalent to an AI agent for creating game assets.

– Oraichain ($ORAI): A company that provides AI Layer 1 data economies and Oracle services, aiming to create a trusted AI tool to support Web3, scalable dApps, and data economies. The project recently provided a token analysis tool called DeFi Lens, while also adding AI agent capabilities for predictive analysis of tokens.

Due to limited resources, we have not listed all the projects related to AI agents in the market.

However, whether it is the above-mentioned projects directly or indirectly related to AI agents, besides the hot concept of AI, it is more important to see if their AI agent businesses have really been implemented and are usable, rather than just empty talk.

The AI bubble is significant, and the bubble of crypto projects riding on the AI trend may be even bigger.

Focusing on projects with more solid fundamentals will be more conducive to capturing solid and sustainable value during the year-long AI narrative.

AI agent.