New York Community Bancorp (NYCB) suffered a massive sell-off due to its disappointing financial report and announced dividend reduction. NYCB also has some minor connections to the cryptocurrency field, as its subsidiary, Signature Bank, has taken over Circle deposits in the past. This inevitably brings to mind the banking crisis that erupted in the United States in March of last year.

Contents:

Toggle

New York Community Bancorp hits new daily low

Banking stocks affected by NYCB’s influence

Taking over Signature Bank and being a former Circle deposit bank

BitMEX founder: Bitcoin will rise

New York Community Bancorp hits new daily low

New York Community Bancorp, Inc. (NYCB) announced its fourth-quarter financial report on the 31st, reporting a net loss of $252 million and announcing a significant dividend reduction.

NYCB reduced its quarterly dividend from $0.17 per share to $0.05 per share, a 71% decrease from the previous quarter. This means that NYCB holders’ cash income will be reduced by two-thirds.

Advertisement – Continue reading below

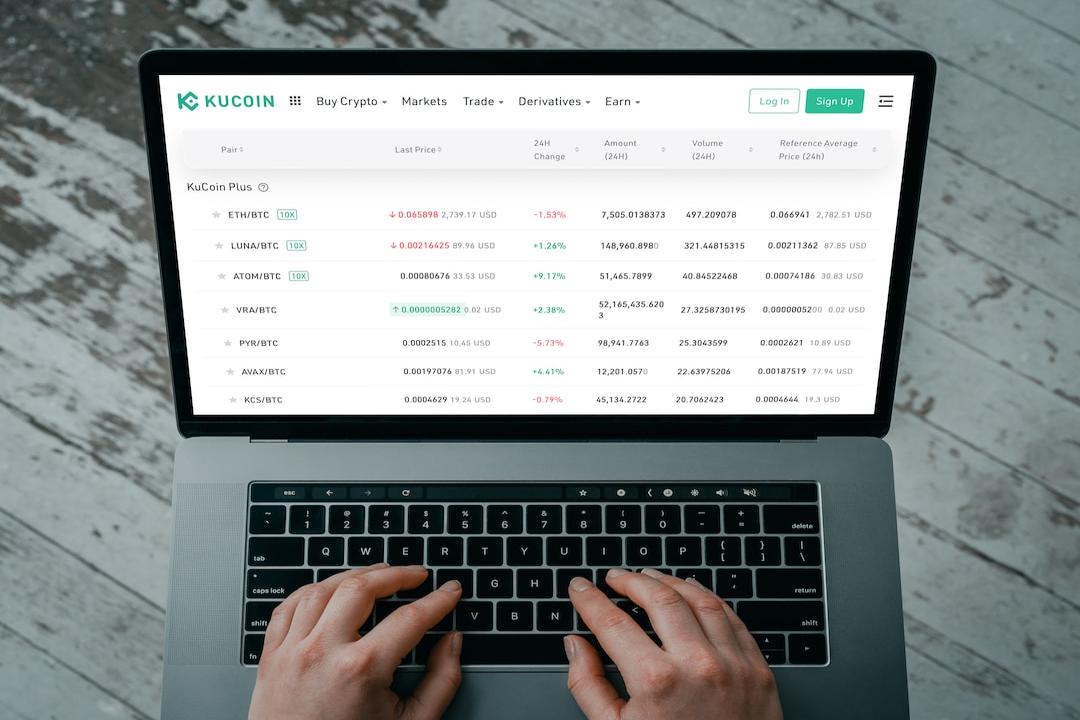

Shortly after the evening session of NYCB’s opening on the U.S. stock market, it plummeted by 46%, with a daily decline of 37%, marking the largest single-day drop for NYCB.

NYCB stock price

Banking stocks affected by NYCB’s influence

According to NYCB’s financial report, the bank lost $360 million in the fourth quarter last year, or $0.36 per share.

This is significantly lower than analysts’ expected earnings of $0.27 per share. NYCB CEO Thomas Cangemi stated, “Reducing dividends is to ensure sufficient capital to sustain business development and lay the foundation for our future growth.”

NYCB’s crash also affected other banking stocks, with other mid-sized banks such as Valley National Bancorp (VLY), BankUnited (BKU), and Western Alliance (WAL) also experiencing declines.

Taking over Signature Bank and being a former Circle deposit bank

According to previous reports, New York Community Bancorp has several banks under its umbrella, including Community Bank, Ohio Savings Bank, and Flagstar Bank, with a total of 225 branches.

Flagstar Bank is also one of the deposit banks for stablecoin issuer Circle.

In addition, during the banking crisis in the first quarter of last year, New York Community Bancorp took over some of Signature Bank’s assets in a supportive role, leading to its current predicament.

(

Flagstar Bank takes over Signature by giving up related deposits for digital banking business

)

BitMEX founder: Bitcoin will rise

Arthur Hayes also noticed the sharp drop of New York Community Bancorp and believes that the Federal Reserve and the Treasury Department will soon restart their money printing measures. The reasons include:

NYCB’s “unexpected loss” this time is because loan loss reserves have increased tenfold as compared to expectations, and the bank has not yet recovered.

The yields of 2-year and 10-year government bonds have declined, and there is an expectation of some form of relief measures.

The Federal Reserve’s previous bailout plan, BTFP, may no longer be effective.

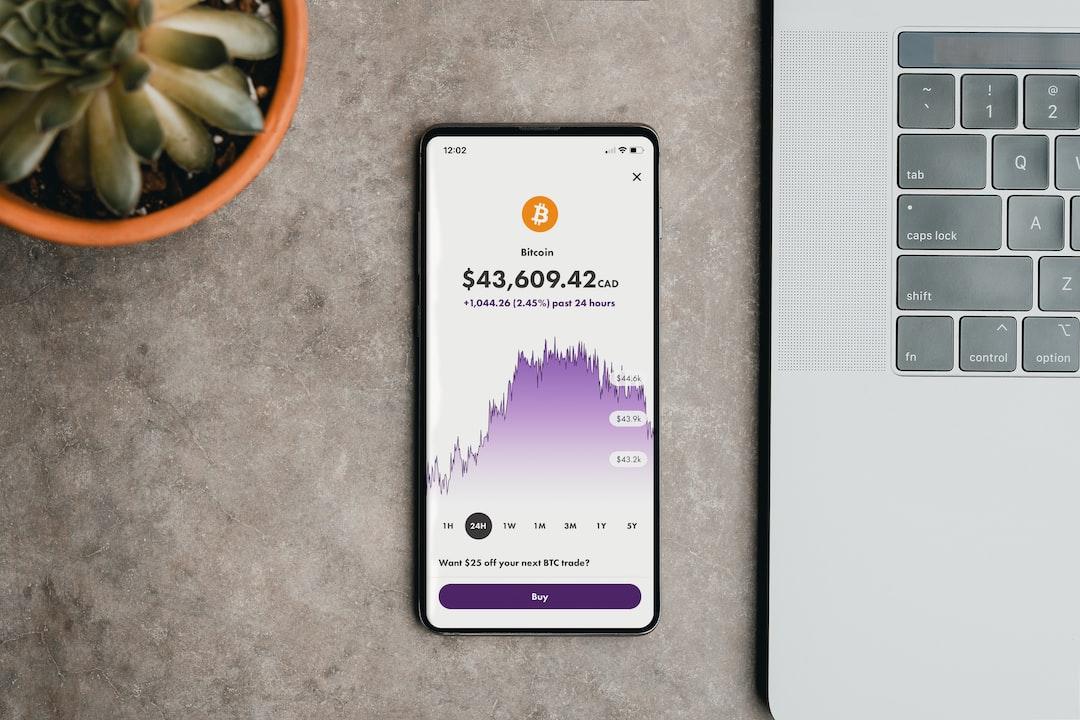

He predicts that Bitcoin will experience a small decline, and if New York Community Bancorp and related bank stocks continue to fall over the weekend, he believes that government assistance will come faster, and Bitcoin will initiate a new round of growth, just like its trend in March last year.

(

Arthur Hayes discusses BTFP, the deflation caused by the banking system will occur, and the Federal Reserve will soon lower interest rates

)

BTFP

Circle

New York Community Bancorp

NYCB

Bitcoin

New York Community Bancorp

Further reading

Bitcoin’s 50% surge sparks mining frenzy, U.S. Department of Energy demands energy reports from mining companies

German government seizes 50,000 bitcoins, becomes the fourth-largest holder after the U.S., Japan, and the UK