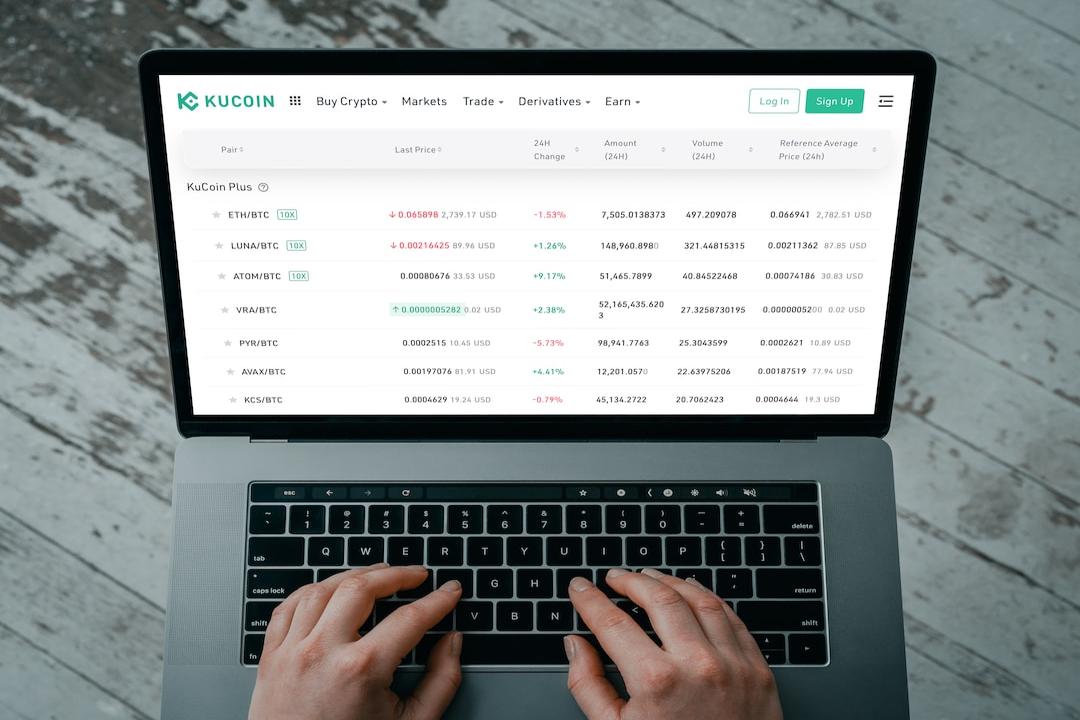

Last night, the US announced that the CPI for January was 3.1%, higher than economists’ forecast of 2.9%. This has dampened market expectations for future rate cuts, pushing up bond yields. The three major US stock indices were down, and Bitcoin briefly fell below $49,000, while Ether also briefly dropped below $2,600.

Contents

Toggle

Expectations of rate cuts cool down, US bond yields soar

BTC briefly falls below $49,000, ETH below $2,600

Last night, the US announced that the CPI for January had slowed from the previous month’s 3.4% to 3.1%, but it still exceeded economists’ forecast of 2.9%.

According to CME Group’s FedWatch, market expectations for a rate cut in March have diminished. The probability of a rate cut in May dropped to 62.1%, and in June it was 55.8%, indicating that the market expects the Federal Reserve to have only one rate cut before June.

As a result, US bond prices have dropped significantly, with the yield on 10-year bonds surging by 14 basis points to 4.315%.

Bitcoin reached the $50,000 level in the previous two days, reaching a high of $50,368, marking a two-year high.

However, Bitcoin also experienced a sharp decline after the announcement of the CPI, falling below $49,000 to $48,300 at one point. At the time of writing, it has returned to $49,520.

Ether, on the other hand, has shown relative weakness. The recent peak of $2,686 did not surpass the mid-January level of $2,717. It briefly fell below $2,600 last night and is currently trading at $2,629.

BTC

CPI

ETH

Further reading

EigenLayer, the re-opened collateral project, allows staking until February 9, with a TVL surpassing $3 billion

Ethereum’s Cancun upgrade successfully goes live on Sepolia, final testnet Holesky to launch on February 7