According to data provided by ETF analyst Eric Balchunas from Bloomberg, the iShares Bitcoin Spot ETF (IBIT) from BlackRock currently accounts for over half of BlackRock’s net inflows since the beginning of the year, and it is double the size of the other 420 ETFs. BlackRock’s diversified investments and high market sensitivity have brought enormous business opportunities in this new market.

Table of Contents

Toggle

Diversified Investments and High Market Sensitivity of BlackRock

Bitcoin ETF Generates Rich Income for BlackRock

Although Vanguard claims to be the inventor of ETFs, its overall market share is slightly lower than BlackRock. In the frenzy of the Bitcoin spot ETF, Vanguard has also chosen to strengthen its “non-cryptocurrency” investment policy.

(Why not launch a Bitcoin ETF? Vanguard explains: immature speculative asset with no intrinsic value)

Advertisement – Continue reading below

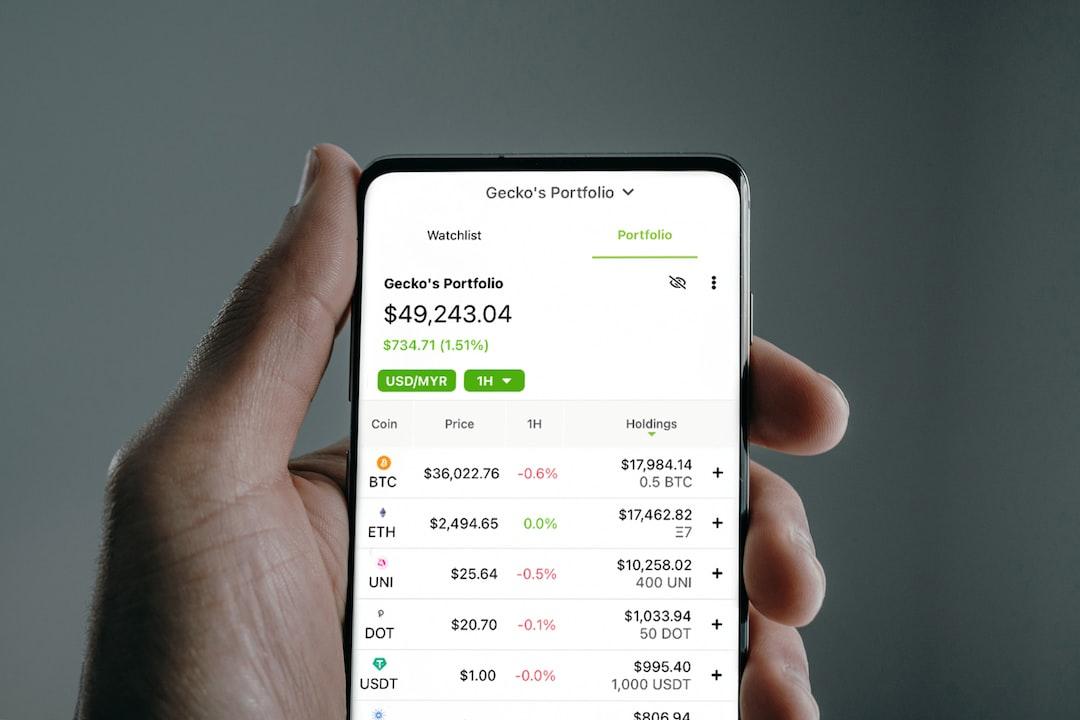

Balchunas analyzes why BlackRock is the only company that can keep up with Vanguard’s pace. It is because their investment scope is highly diversified, constantly seeking new sources of growth to supplement their core business, and this is also the reason they turned to Bitcoin. The chart below shows the market share of issuers divided by asset class, indicating BlackRock’s diversification. Its share in commodity ETFs is 30%, while its share in thematic categories is 14.1%. In contrast, Vanguard has not invested in either of these two categories.

Source: Bloomberg

The frenzy of the Bitcoin spot ETF is also driven by BlackRock, currently bringing at least $24.6 billion in inflows to the market (excluding Grayscale GBTC).

Balchunas also mentioned that BlackRock’s IBIT and Fidelity’s FBTC have set a record of 49 consecutive days of inflows, which only 30 ETFs had before.

What is quite crazy is that IBIT currently accounts for over half of BlackRock’s net inflows since the beginning of the year and is double the size of the other 420 ETFs. FBTC has a greater influence within the company, accounting for 70% of Fidelity’s year-to-date flows, which is 5 times more than any other ETF.

According to BlackRock’s 2023 annual report, the company had net inflows of $288.7 billion last year, while IBIT has already seen inflows of $13.3 billion in just over two months. With an expense ratio of 0.12% and an asset size of $15.8 billion so far, it can generate $19 million in annual income. And whether Bitcoin goes up or down, BlackRock is the biggest winner!

IBIT

Fidelity

Bitcoin Spot ETF

BlackRock

Related Reading

Bitcoin ETF sees outflows for two consecutive days, BTC falls below $61K, recording the largest daily decline since the FTX incident

Bitcoin spot ETF’s ten-day streak of net inflows ends, GBTC sees record outflows