EigenLayer Team Announces the Launch of EIGEN Token and Three Consecutive Airdrop Activities, as well as the Establishment of Eigen Foundation. According to the whitepaper, the main purpose of the EIGEN token is to stake and secure the AVS project, complementing ETH staking to make the EigenLayer ecosystem more secure.

Table of Contents

Toggle

Background: Introduction to EigenLayer

Economic Model of EIGEN Token

Basic Information of EIGEN Token

Distribution Method of EIGEN Token

Utility of EIGEN Token

Intersubjectively Attributable Faults

Resolving Intersubjectively Attributable Faults: Social Consensus

EIGEN Token Ensures Security through Forking Mechanism

Establishment of Eigen Foundation

Currently, the EigenLayer protocol has a total value locked (TVL) of over $15 billion and is ready to launch nine actively validated services (AVS). According to the team’s announcement, there are currently over 50 decentralized projects preparing to launch on EigenLayer.

Recommended Reading:

How will EigenLayer’s re-staking project change the Web3 infrastructure?

Reason for Recommendation: This article provides a comprehensive explanation of EigenLayer’s design concepts, problem-solving, and current development status. It helps readers quickly understand the roles of various participants in the ecosystem, including token stakers, node operators, and AVS providers. It also provides insights into the content of this article.

Advertisement – Please scroll down for more content

Name: EIGEN

Mainnet: Ethereum (ERC-20)

Address: Not yet online

Total Supply: 1.8 billion tokens

Developers and investors will receive 55% of the token allocation, which will be locked for one year and linearly unlocked in the second and third years. The community will receive 45% of the token allocation, and all tokens are currently non-transferable.

Airdrop: 15%

Marketing Plan: 15%

Ecosystem Development: 15%

Investors and Developers: 55%

The airdrop will be distributed over three seasons, with 5% of the total tokens being distributed each season. The first round of the Stakedrop Season 1 airdrop will be divided into two phases, with 4.54% and 0.46% of the tokens being distributed respectively, totaling approximately 83.68 million and 7.77 million EIGEN tokens. The eligibility for the airdrop can be checked on the following webpage:

https://claims.eigenfoundation.org/

.

(EigenLayer opens eligibility check for airdrop! The first phase is mainly for re-staking users, while Pendle will be distributed in the second phase.)

Currently, some types of errors in the Web3 ecosystem cannot be solved solely by mathematical or cryptographic means on the blockchain. For example, the exchange rate of Bitcoin to USD relies on oracles.

Currently, the security of the Ethereum network relies solely on Ethereum’s PoS network consensus, which can only protect the on-chain world, such as token quantities, NFT holders, DeFi liquidation rules, and on-chain governance results. Whenever off-chain information is involved, additional risk assumptions are usually required, such as the need for oracles to assist with token-to-USD exchange rates or corresponding storage facilities for data availability (DA).

The EigenLayer team refers to errors resulting from these risk assumptions as intersubjectively attributable faults, which are problems caused by trust assumptions between the blockchain and external entities. Although the blockchain alone cannot determine these errors, they can be identified through external observations and consensus among observers.

While malicious behavior on the chain can be mitigated through smart contract implementation (slash), smart contracts are not sufficient for errors between different entities. This is because from the perspective of the EVM, it is not clear whether intersubjective faults have occurred between entities, but it is clear to external observers.

The most important use case for the EIGEN token is to ensure the accuracy of external data to the blockchain. However, let’s first talk about the existing solution: social consensus.

Currently, the approach to solving these intersubjectively attributable faults is through social consensus. If the result proposed by an individual is different from the majority of other participants, there are several mechanisms in the industry to address this issue:

– Reducing the stake of the participant (usually tokens)

– Establishing a committee to combat the participant

– Reducing the stake of the participant through forking

The first two mechanisms are prone to majority violence, and stakeholders other than actively responsive node operators will be negatively affected. The third mechanism involves social consensus and can still reduce the stake even in the case of corruption among most node operators.

Therefore, the EIGEN token will utilize the third mechanism to prevent and optimize intersubjectively attributable faults.

The EIGEN token is responsible for ensuring the intersubjective faults in the Ethereum ecosystem, filling the gaps that smart contracts cannot govern beyond risk assumptions.

The value of the token comes from external reference frameworks or social consensus, and token forking is a mechanism that uses this external reference framework for cryptographic economic punishment in value distribution.

The core idea is that if a fault is caused by the misconduct of the majority of EIGEN token stakers, any challenger can create a token fork where malicious EIGEN token stakers will be reduced.

After the fork, there will be two possible versions of the EIGEN token, and users and AVS can freely decide which one to respect and value. If the behavior of the reduced stakeholder is generally considered improper, users and AVS will prioritize the new fork instead of the original EIGEN distribution.

Since malicious stakers have no allocation in the forked tokens, they lose the inherent original value of their stake. The industry refers to this mechanism as slashing-by-forking.

It is evident that one fundamental principle of the EIGEN token is that only when the fault of the EIGEN token staker is beyond doubt (known by the market as malicious actors) and any two rational observers would agree that punishment is necessary, can the reduction of EIGEN token stakers be successful. In such cases, reduction requires a large amount of collusion and potential financial loss, and the expectation is that EIGEN forking is the last option but still necessary to ensure correct behavior by stakers.

To mitigate the risk of fork attacks, EIGEN forking requires the staking of EIGEN tokens. If the fork is verified by social consensus, the challenger will recover their own tokens and the tokens of the malicious actor as a reward in the fork. However, if social consensus rejects the fork, the challenger’s committed tokens will be burned.

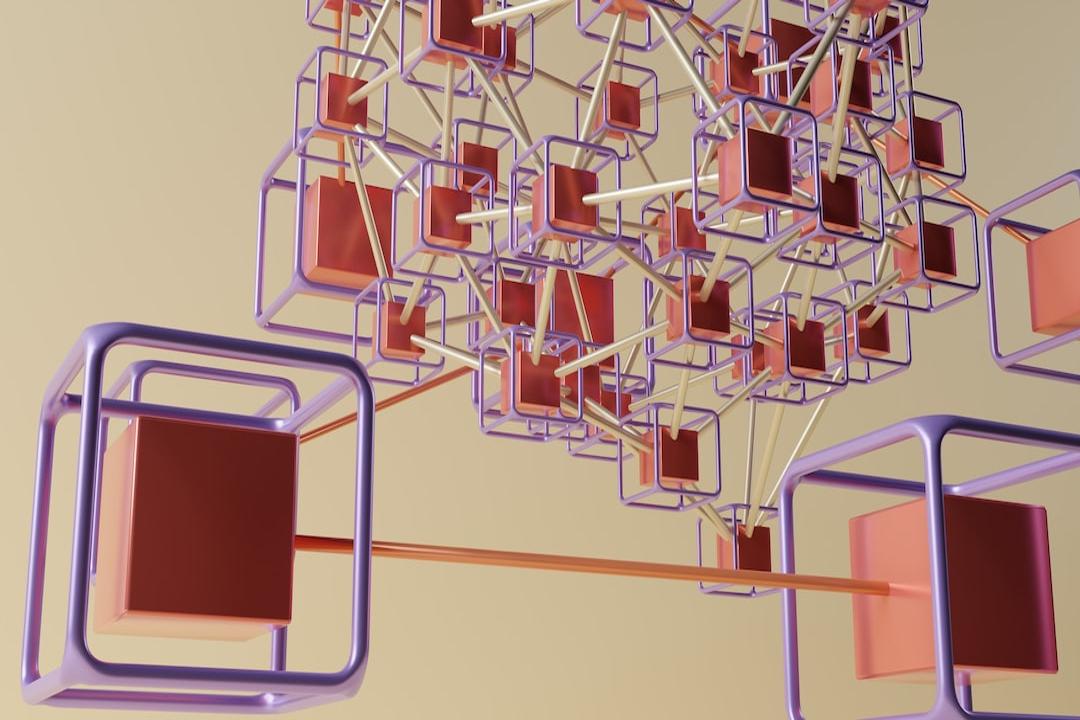

To implement the above mechanism, the EigenLayer protocol will enable dual-token staking to protect specific AVS (currently only EigenDA) by using dual staking of ETH and EIGEN. Re-staking will absorb ETH to strengthen decentralization within the blockchain network, while EIGEN token staking can support reduction between entities.

EigenLayer Ecosystem Economic Security Framework

(Data source)

ETH and EIGEN tokens will complement each other to maximize the network security of AVS.

Eigen Foundation

is an independent entity with a mission to promote the development of the EigenLayer ecosystem and support research, development, and funding of the EigenLayer protocol.

Eigen Foundation is also responsible for the current airdrop activity of the EIGEN token and future resource allocation.

EIGEN

EigenLayer

ETH

Further Reading

EigenLayer opens eligibility check for airdrop! The first phase is mainly for re-staking users, while Pendle will be distributed in the second phase.

EigenLayer restarts LST staking, TVL surpasses $12.7 billion, closely following Lido.