According to Bloomberg Markets Live Pulse, one-third of the population chooses to invest in US technology stocks as a hedge against inflation, far surpassing the 5% who choose Bitcoin. Technology stocks represent a bet on innovation and, in the rapidly growing environment of AI applications, not only provide protection against inflation but also offer excellent returns.

Contents

Toggle

One-third of investors choose technology stocks to combat inflation

Tech giants steadily rise as a tool against inflation

According to a real-time market pulse survey conducted by Bloomberg in May, when asked about investment options to combat inflation, 46% of participants chose traditional gold, but 30% of respondents stated that tech giants were their top choice, while only 5.1% chose Bitcoin as a hedge against inflation.

This survey highlights the dominant role played by companies such as Nvidia, Amazon, and Meta in the US financial market, as they expand their influence in key sectors of the economy. This enables them to generate stable profits and maintain rising prices, leading investors to believe that they will continue to be a stable source of income.

Advertisement – Continue scrolling for more content

Especially in the aftermath of the bank run crisis that the US experienced last year, investors who previously saw financial stocks as a stable source of income shifted their focus to the seven major US tech giants. These tech giants, with their rapid growth advantages in AI applications, have seen significant increases in stock prices since 2022, with Nvidia rising 224%, Meta (Facebook’s parent company) rising 36%, Google rising 19%, and Amazon rising only 1% due to the high base period caused by the pandemic.

Furthermore, these tech giants have experienced significant increases in stock prices due to continuously rising profits and heightened valuations. Although tech companies, like other growth stocks, are sensitive to changes in inflation and interest rates, tech giants have little financing needs due to their cash-rich positions. Instead, they have subtly replaced financial stocks as an investment option in the US market after the banking crisis.

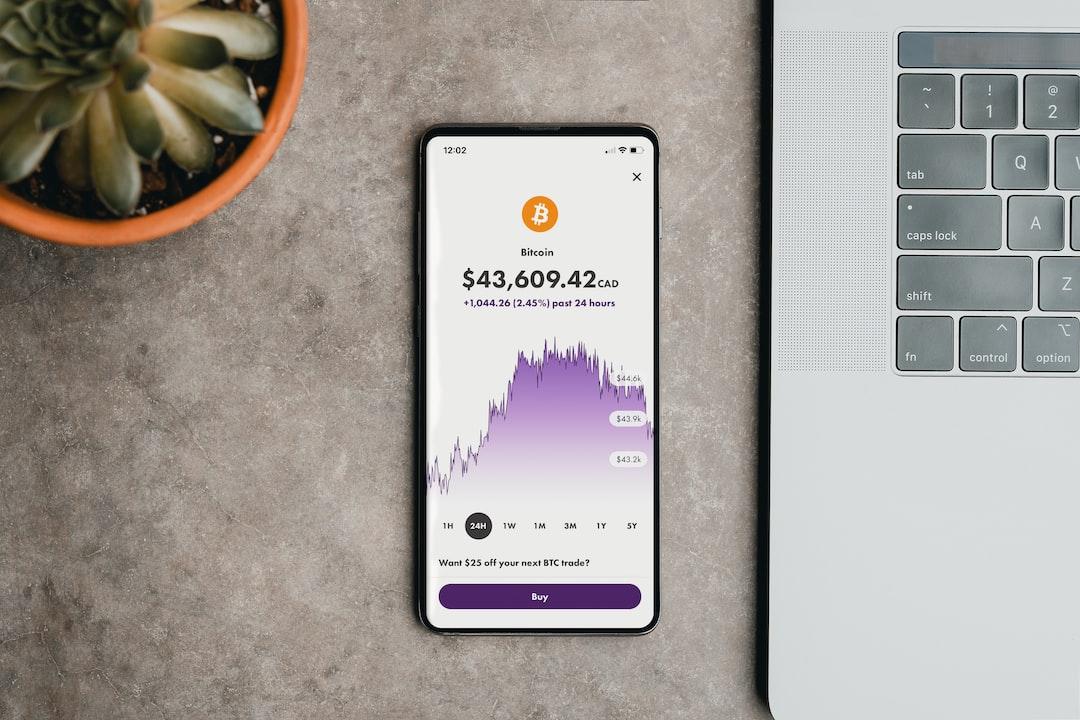

While Bitcoin has also experienced a high increase of up to 20%, its high volatility and limited investment channels compared to tech stocks result in only 5.1% of people choosing Bitcoin as a hedge against inflation.

Bloomberg Markets Live Pulse

Bitcoin

Tech stocks

Inflation

Further reading

5/15 Bitcoin ETF sees at least $300 million in net inflows, GBTC sees $27 million in purchases

Can’t wait for rate cuts? US faces inflation pressure, Fed faces difficult rate decision.