Bitcoin has been falling since June 5th, when it reached $71,754. The pressures faced by the cryptocurrency market include outflows from spot ETFs, Bitcoin sales by mining companies, and even the sale of confiscated Bitcoins by governments.

Contents:

Toggle

Outflows from ETFs for six consecutive days

Continuous Bitcoin sales by mining companies

Governments abandon Bitcoin auctions and turn to exchange sales

Outflows from ETFs for six consecutive days

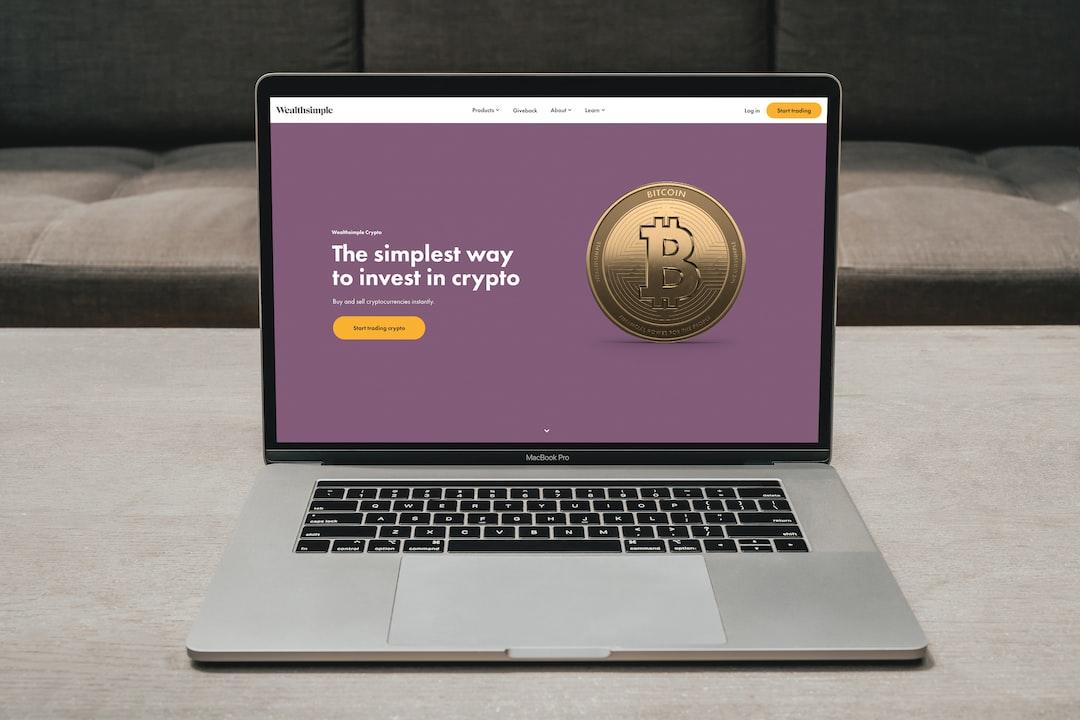

According to data compiled by Bitcoin.com, Bitcoin has fallen from $67,301 to $62,913 in the past week, and spot ETFs have experienced net outflows for six consecutive days.

The total outflow of funds over the six days amounts to $960.2 million (equivalent to over 15,000 BTC), and the current total assets under management of 11 Bitcoin spot ETFs are approximately $55.55 billion.

Net outflows from Bitcoin spot ETFs

Continuous Bitcoin sales by mining companies

The Bitcoin reserves held by mining companies have also decreased. Between June 20th and June 22nd, mining companies’ Bitcoin reserves decreased by approximately 1,125 BTC. The expected earnings per second of mining power is still above $50, which means that mining costs have increased, especially in terms of equipment, electricity, and other operational expenses.

Government abandons Bitcoin auctions and turns to exchange sales

In addition, German authorities transferred approximately $200 million worth of Bitcoin from their wallets last week. The fund transfer involved exchanges such as Coinbase, Kraken, and Bitstamp, and is considered to be the sale of a portion of the assets. The German authorities still hold 47,179 BTC.

Federal Criminal Police Office of Germany (Bundeskriminalamt, BKA)

Bitcoin address of the UK government

Bitcoin.com points out that governments around the world seem to be abandoning auctions and opting to sell confiscated Bitcoins directly on mainstream exchanges.

According to the Bitcoin holdings data platform BitcoinTreasuries, the US government holds 217,486 BTC, worth $13.9 billion, ranking first globally. They also hold 53,900 ETH, worth $187 million. China comes next with 190,000 BTC, followed by the UK with 61,245 BTC, and Germany with 47,179 BTC. In total, the Bitcoin holdings of governments worldwide account for 2.7% of the total supply.

US government’s cryptocurrency addresses

ETH

Bitcoin

Bitcoin spot ETFs

Further reading

Standard Chartered Bank plans to launch Bitcoin and Ethereum trading platform in response to customer demand

Report: What are the main risks of Ethereum Pectra upgrade?